Published on 27/03/2019

SHARE

Staff members value a caring employer while on incapacity leave

Last time, you saw that staff members overestimate their statutory incapacity benefits. This time, it will be clear that they worry about this, and rightly so. Fortunately, as an employer, you can help. And there is an upside for you as well. How? Find out more in this third article on the occupational incapacity survey we have carried out in cooperation with Vlerick Business School.

Last time, you saw that staff members overestimate their statutory incapacity benefits. This time, it will be clear that they worry about this, and rightly so. Fortunately, as an employer, you can help. And there is an upside for you as well. How? Find out more in this third article on the occupational incapacity survey we have carried out in cooperation with Vlerick Business School.

In a nutshell, what are the main findings?

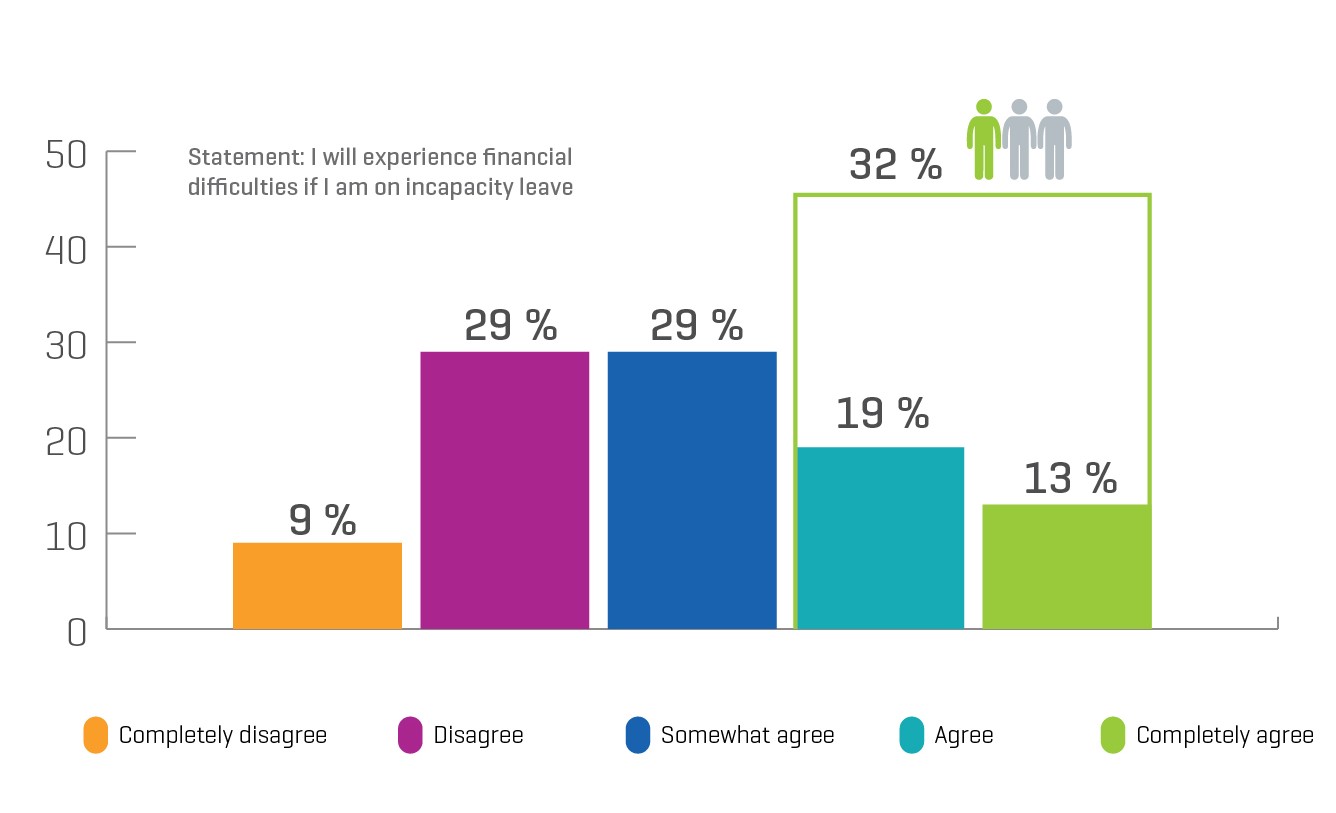

- 1 out of 3 expect to experience financial strain while on incapacity leave

- Extra protection provided via the employer is highly valued

- 94% want a higher budget for income protection

1 out of 3 expect to experience financial strain while on incapacity leave

In our previous article, you saw that employees often overestimate the size of their statutory incapacity benefits (and you can also run the numbers yourself via our

handy simulation tool. Once shown the real size of their replacement income, a good 8 out of 10 respondents expect to see a drop in their standard of living. 1 out of 3 even worry that they will have major financial difficulties. Employees with a salary below the INAMI/RIZIV cap of EUR 3,633 per month are particularly at risk in this group.

In our previous article, you saw that employees often overestimate the size of their statutory incapacity benefits (and you can also run the numbers yourself via our

handy simulation tool. Once shown the real size of their replacement income, a good 8 out of 10 respondents expect to see a drop in their standard of living. 1 out of 3 even worry that they will have major financial difficulties. Employees with a salary below the INAMI/RIZIV cap of EUR 3,633 per month are particularly at risk in this group.

Professor Baeten cautions that these employees probably do not have enough savings set aside to absorb a financial setback. "For many of them, it can be quite terrifying to suddenly lose a few hundred euros from a net salary of roughly EUR 2,000. In the meantime, their fixed costs continue as usual, not to mention that with an illness, there are often additional expenses. So higher outflows to cover, with less money."

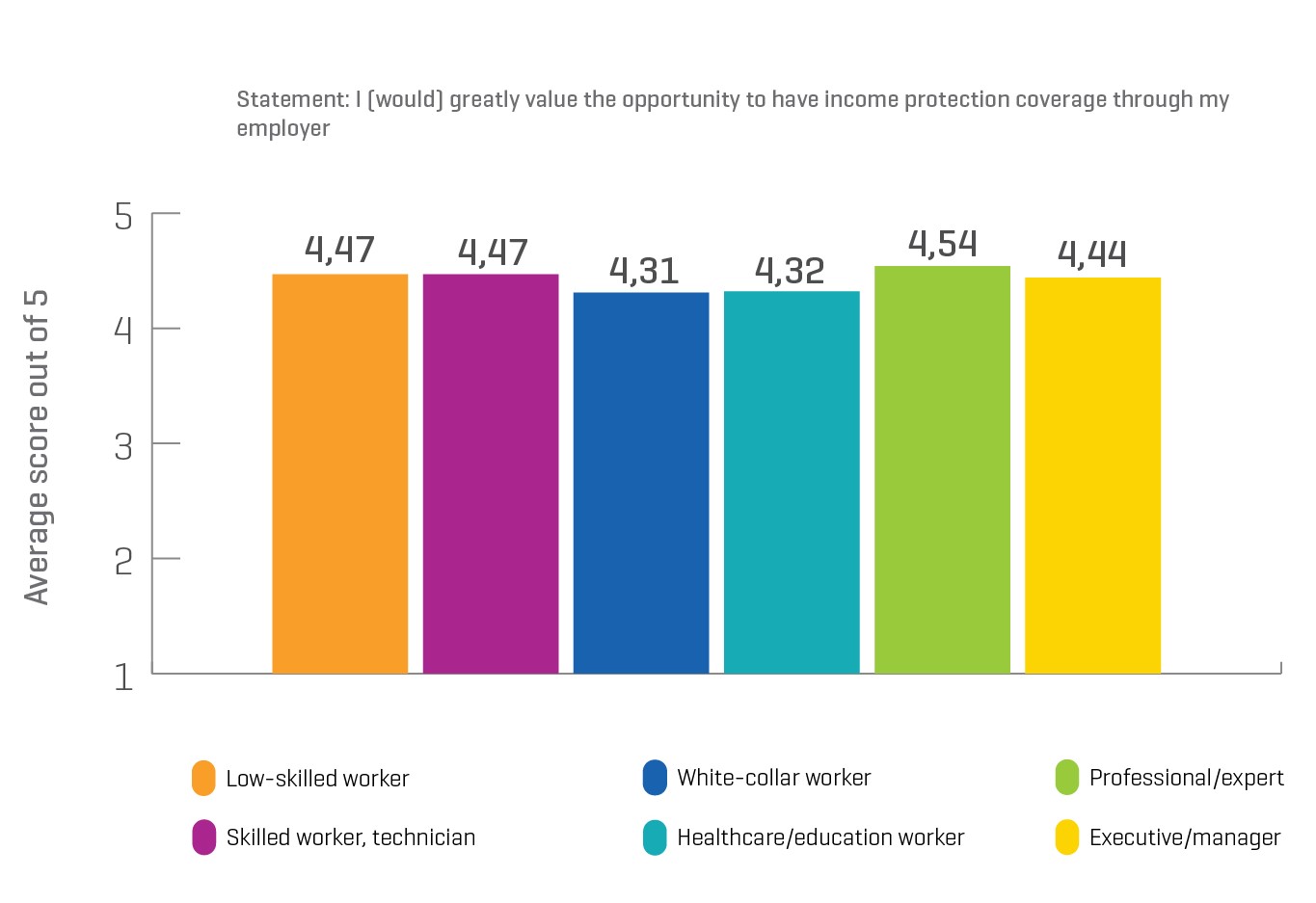

Extra protection provided via the employer is highly valued

Not surprisingly,

over 90% of the employees surveyed indicated that they would greatly value the opportunity to have Income Protection insurance

through their employer. This type of coverage pays out a monthly replacement income on top of the statutory incapacity benefits.

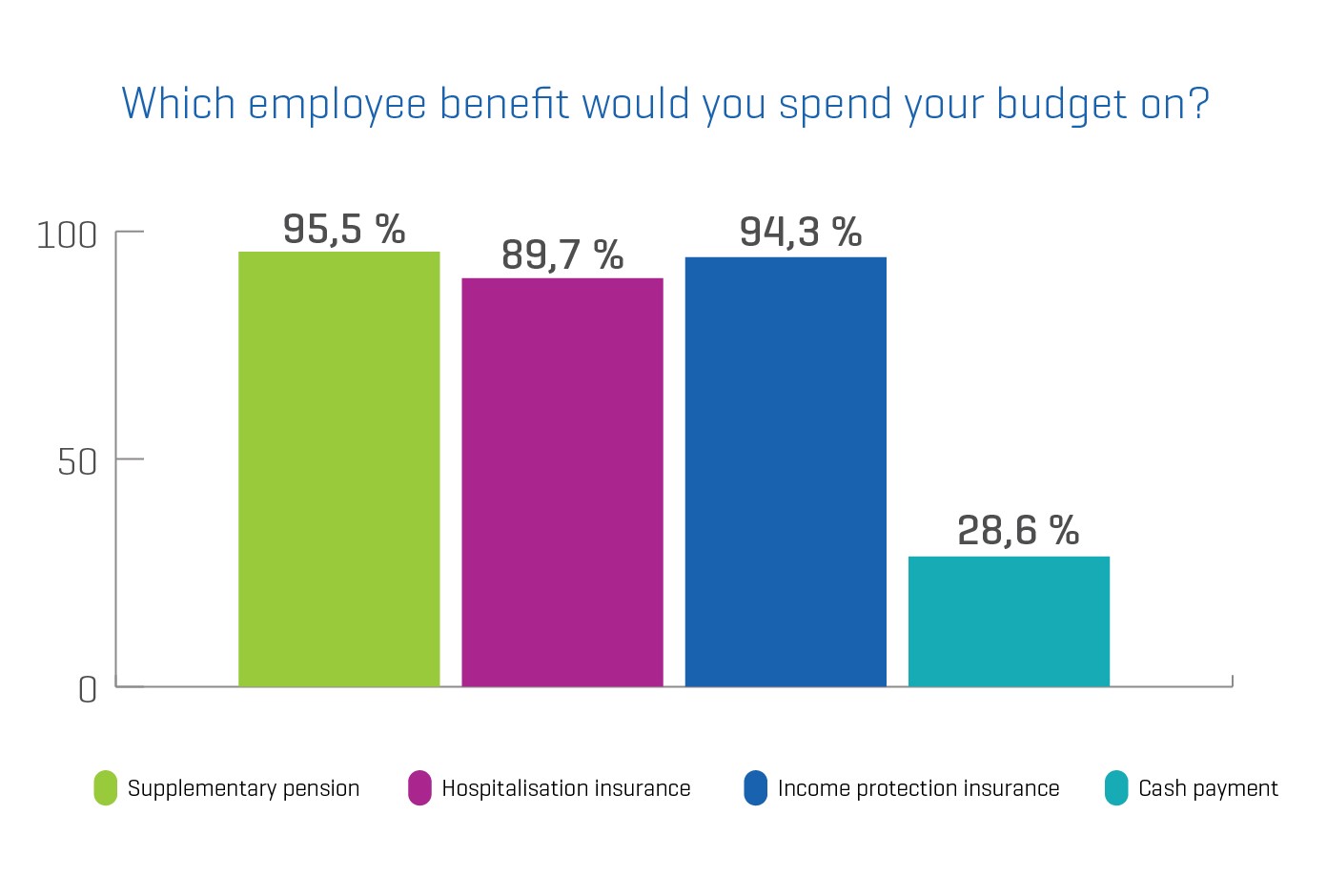

94% want a higher budget for income protection

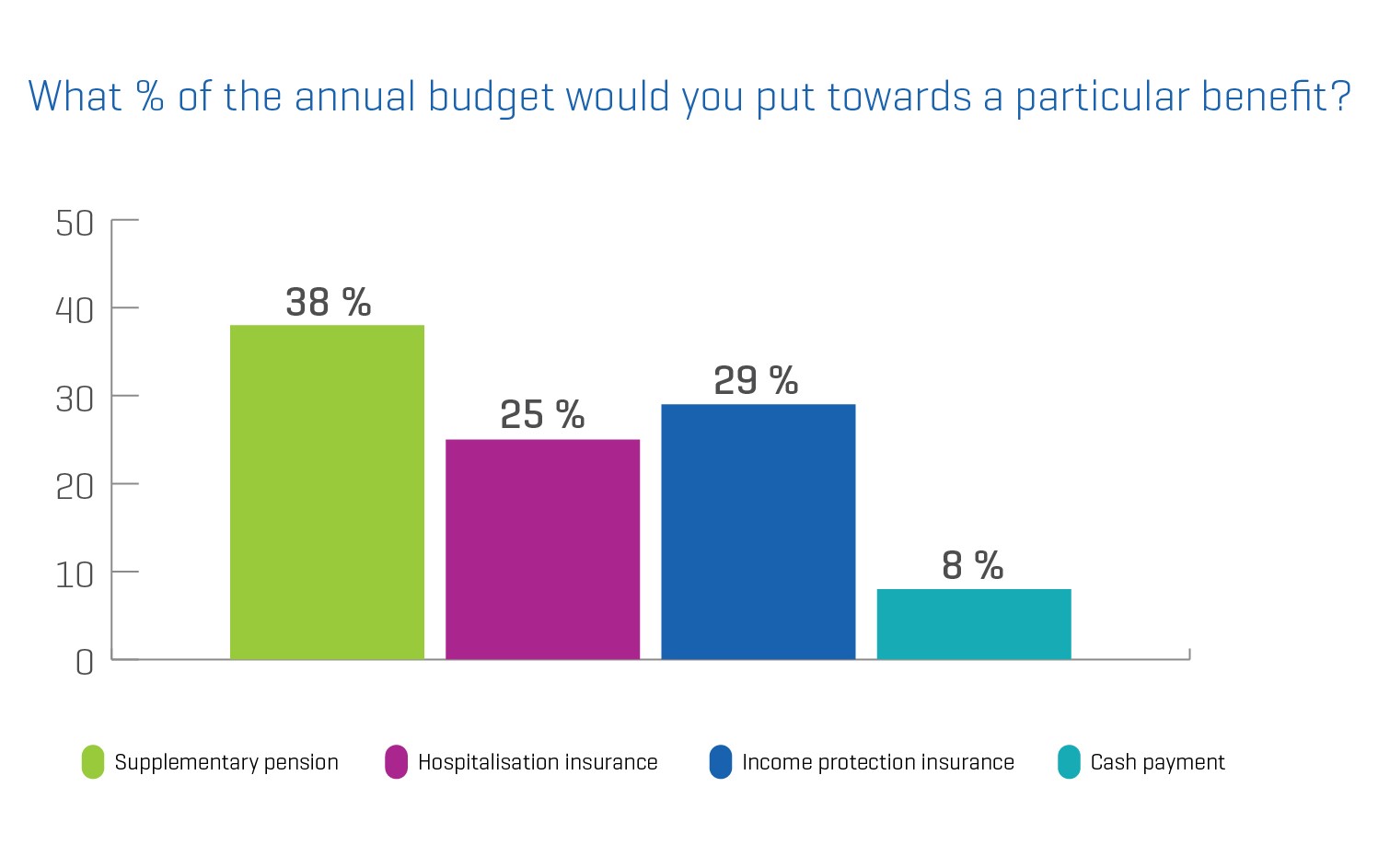

We asked the respondents to make an estimate of their gross salary. Based on this number, they could run a simulation on how they would spend their Employee Benefits budget.

The popularity of Income Protection insurance was particularly striking.

The respondents would allocate 29% of their EB budget to this benefit. Figures show that 20% is more than enough to fund extensive Income Protection coverage.

In total, 94% of the respondents opted to spend a chunk of the budget on Income Protection, which puts it on equal footing with more "classic" corporate-sponsored benefits such as hospitalisation insurance or a supplementary pension. According to Professor Baeten, this striking discovery also represents an interesting opportunity for employers.

In total, 94% of the respondents opted to spend a chunk of the budget on Income Protection, which puts it on equal footing with more "classic" corporate-sponsored benefits such as hospitalisation insurance or a supplementary pension. According to Professor Baeten, this striking discovery also represents an interesting opportunity for employers.

"The research shows that employees overestimate the size of their statutory incapacity benefits, and that they assume their standard of living will decline if ever they are on long-term sick leave. Given that only 40% of the employees surveyed currently have Income Protection coverage, there is still a lot of potential for companies looking to raise their profile as a caring employer."

In cooperation with AG Insurance, Professor Xavier Baeten from Vlerick Business School collected experiences and expectations about occupational incapacity in Belgium. The main findings are already available for your review

here.

In this series of four articles, we will be delving deeper into the research results.

Missed the previous articles? You can read them here:

- Article 1: Survey on incapacity for work in Belgium: alarming figures

- Article 2: Your staff members overestimate social security incapacity benefits

At the end of April, we will send you the final article plus exclusive access to the full whitepaper.

Interested in the Vlerick research findings? Want to find out more about corporate-sponsored Income Protection insurance? Contact us via the green button.

We will be happy to personally walk you through the survey results, or see how our expertise can best support your needs.