What are the key differences between these two types of group insurance plans? Read on for all the details, so that you can make the right choice at any time.

Defined Benefit (DB) plans

These are the most common plans among older employees. The future pension amount is predetermined based on a formula that considers the employee’s

years of service and salary.

Your employees will know in advance the pension amount they can expect upon retirement. However, as an employer, you bear the risks of investment returns and potential increases due to wage indexation or wage hikes.

It's difficult to predict how the contributions will evolve over time, which is why these types of plans are less sought after today.

Defined Contribution (DC) plans

In this type of supplementary pension plan, the

contributions are fixed, but not the benefit amount the employee will collect upon retirement. In most cases, the contribution is a

percentage of the employee’s gross monthly salary or a

lump sum. The benefit amount payable upon retirement will not only depend on the size and duration of the contributions, but also on the return earned on these contributions. With a DC plan, the members bear the investment risk, but they are safeguarded by the statutory minimum return guarantee. The advantage for you as an employer is that the

cost of the pension plan is easier to estimate.

Since the mid-90s, almost all newly started pension plans have been defined contribution plans. Why? This shift is largely due to employers wanting to mitigate risks and uncertainties associated with pension plans. Additionally, employees are seeking

transparency, clarity, and simplicity in their plans. DC plans also provide the flexibility for employees to make certain choices.

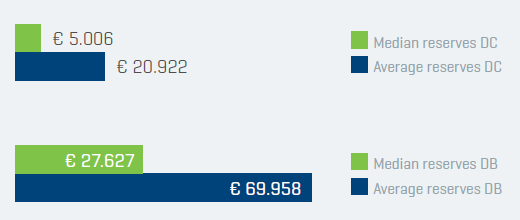

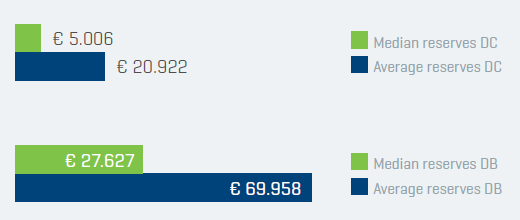

Our benchmark study on corporate group insurance plans also shows a marked preference for DC plans over DB plans: more than 75% of AG plan participants have a DC plan. However, we do see that these plans have lower reserves than DB plans.

So why are the reserves held in DC plans lower?

Often, DB plans have been running for a long time, and their participants are

older employees who have been working for longer and as a result have also saved more. Furthermore, DB plans are still prevalent

in sectors with higher salaries, typically in larger companies where many employees have been investing in supplementary pensions for an extended period.

The median Defined Benefit (DB) plan for an individual with a nearly full career results in a final capital payout of 5.2 times their annual salary.

Do DB plans also offer a higher replacement rate?

Yes, they do. If we convert the expected benefit payable upon retirement into an annuity, the replacement rate for a (nearly) full career is

at least 10% higher than with DC plans. This is because the target payout at retirement age in these types of plans is often designed to be a good replacement rate compared to the most recent salary.

Choosing the right group insurance plan is a necessity, not a luxury. Now for the key question...

What is the ideal contribution?

If we look at the median contribution percentage for DC plans in our benchmark study, we come to a figure of 3.70%. But is that enough? If we are ambitious, we should aim for a comfortable replacement rate of 70%: 50% via the state pension (first pillar) and 20% via a supplementary pension (second pillar). To reach this 20% in the second pillar, the contribution should be 7.5%. Employees who want more can supplement it with individual investments, such as pension savings plans (third pillar).

How about the ideal formula to earn a decent return on the contributions?

There are two options for offering your employees an attractive DC plan:

-

With

e-volulife, you get a DC plan where premiums are invested in Branch 21, Branch 23 or both, or you can leave the decision up to your employees, depending on their risk appetite. This way, everyone's a winner.

-

With

Pension@ease, you aim for a potentially higher return by investing the Defined Contribution (DC) premiums in volatile branch 23 funds, possibly supplemented with a portion of branch 21. You can systematically transfer the achieved returns to your employees and to a financial buffer that you can utilize during less favorable years.

Your trusted contact person will be more than willing to set aside time to review these formulas with you and identify the best solution for your employees.

BOOK AN APPOINTMENT