Where do things stand with supplementary pensions in Belgium?

Interested in our structured white paper with all the key findings from our unique Benchmark Study on Supplementary Pensions in Belgium? Request your copy by clicking the button:

The Benchmark Study on Supplementary Pensions event held on 20 April 2023 at our AG Campus was a resounding success. Not only because of the engaging speakers, but also because of the surprising content. Read on for the highlights from this successful afternoon!

And for those who missed the presentation, we tackled the subject again in an afternoon webinar as part of the Pension & Health Academy.

Under-contribution for nearly 40% of supplementary pension plans

Benoit Halbart, Managing Director of Employee Benefits & Health Care at AG, pinpointed the importance and key challenges associated with pensions. According to a recent Assuralia study, the public clearly understands the need to save towards a supplementary pension: 75% of the survey respondents are convinced of the importance and 80% think the employer should contribute. The Belgian federal government wants every employee to have access to a supplementary pension by setting aside

at least 3% of their gross annual salary so that they will have a high enough replacement income later on.

Mabelien Coppens (Legal Advisor at the FSMA)

|

|

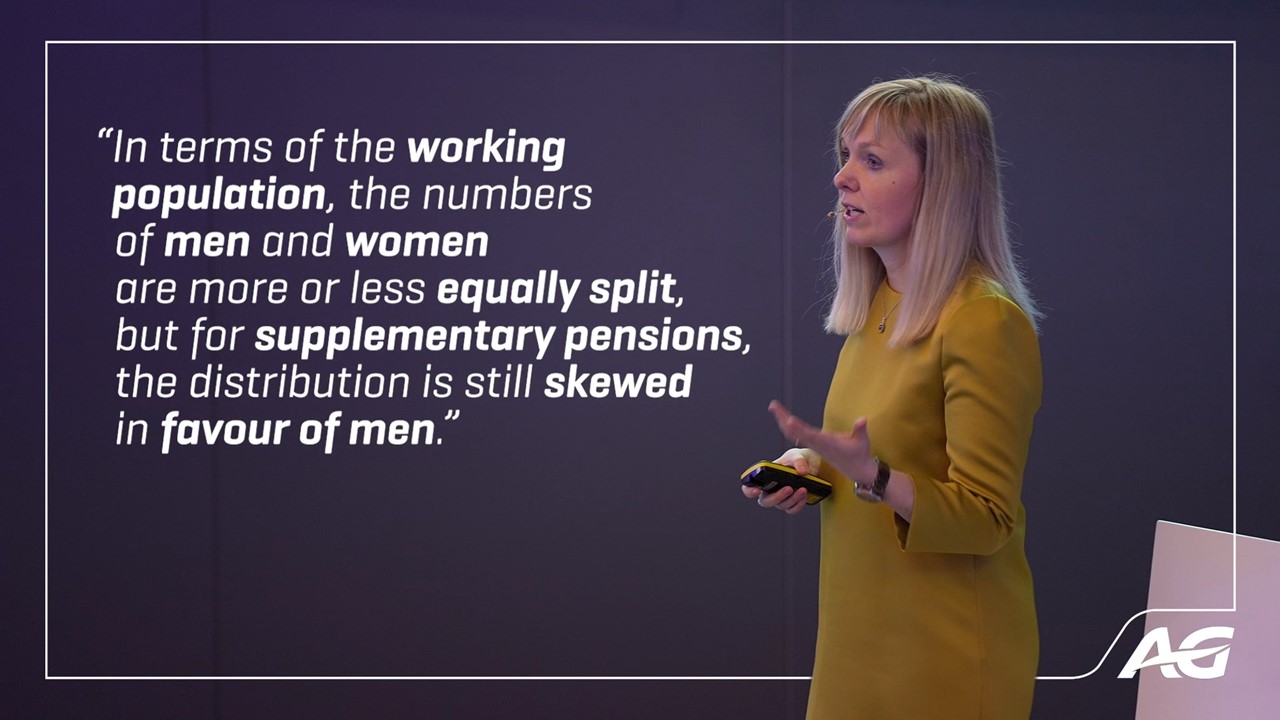

When we review the annual sector report published by the FSMA with

Mabelien Coppens (Legal Advisor at the FSMA), we see that almost 4.2 million people in Belgium were

enrolled in a supplementary pension plan on 1 January 2022, with over EUR 100 billion in accrued reserves already invested. One-third of the active workforce, however, is not actively enrolled in a pension plan. In short, there is still a long way to go.

Another important issue is that the higher the salary, the more the replacement income via the state pension will be proportionally lower. This is because of the cap applied to the salary used to calculate pension entitlements. For example, for an employee with an annual salary between €75,000 and €100,000, the state pension will cover only 29% of his/her replacement income, and the supplementary pension 16%. This means that the total replacement income will only be 45%, very far off from the comfortable replacement rate of 70% recommended by Pierre Devolder (Professor of Finance, UCLouvain). To get to that 70%, the contribution rate would have to be 7.5% instead of the current 3%.

|

Pierre Devolder (Professor of Finance, UCLouvain)

|

As the market leader in supplementary pensions in Belgium, we analysed the contracts of 316,826 participants in 5,374 corporate plans.

Aline

Piersoel and Michel Moreau walked us through the key findings.

Out of the entire AG portfolio of corporate pension plans (excluding sector-wide plans), the

average contribution rate is 4.5% (EUR 2,874 per year) and the median contribution rate is 3.70% (EUR 1,675 per year).

Yet as many as 39% of plan participants don't make the 3% target. There are also big differences between the 18 sectors covered in the study.

And that's not all: the study also reveals significant differences between Defined Contribution plans, with fixed premiums per month, and

Defined Benefit plans, which promise a specified monthly benefit at retirement.

Where do you stand compared to your peers?

Not only are there differences between the 18 sectors surveyed,

we also see varying figures within each sector. Intrigued about how you measure up against your peers? Want to find out if your pension plan will provide your employees with a comfortable replacement income later on?

Make an appointment today to review your sector-wide report.

Your trusted contact person or sales representative will be happy to go over the figures and findings for your sector with you. Want to make sure you stand out on the job market? We'll help you find the right mix, whether it's a Branch 21 or Branch 23 solution or a combination of both.

Make me an appointment

The FSMA figures can be found in the annual sector review on the FSMA website:

Sector overview | FSMA.

Want to take a closer look at Professor Devolder's presentation? Click

here.

Would you like to (re)watch the presentations of our speakers?

Mabelien Coppens' presentation (Dutch):

Pierre Devolders' presentation (French):

Introducing our speakers

Mabelien Coppens

Mabelien has been a Legal Advisor at the FSMA since 2015, where she focuses on the development of structured supervision for the 2nd pillar. In addition to monitoring occupational pension legislation, she is a strong advocate for active, transparent communication. She earned a LL.M degree from the KU Leuven with a specialty in employment and labour law. She spent several years at AG Employee Benefits and did additional coursework in Pension Legislation at the KU Leuven to gain a deeper understanding of pension-related issues.

Pierre Devolder

Pierre is an actuary and holds a D.Sc from the University of Brussels (ULB). He is also a Professor at the Institute of Statistics, Biostatistics and Actuarial Sciences (ISBA) at the Université Catholique de Louvain (UCL), where his research and teaching focus on stochastic finance, life insurance and pension theory. He teaches in Strasbourg, Rabat and Brussels on a regular basis. He is one of the founders and the Chairman of REACFIN, an actuarial consulting firm.

Michel Moreau

As the Head of New Business, Michel is responsible for developing the new customer base in the field of Employee Benefits & Healthcare at AG. He graduated from the KU Leuven as a Commercial Engineer in 1990.

Aline Piersoel

As the Head of Customer Relationship Management, Aline is responsible for commercial relationships in the AG Employee Benefits & Health Care customer portfolio. After her initial degree in Commercial Engineering, she obtained a MSc in Actuarial Science.